Puma Private Equity expands team

Puma Private Equity expands its team with a number of new appointments and promotions to help support its growth in scaling UK businesses

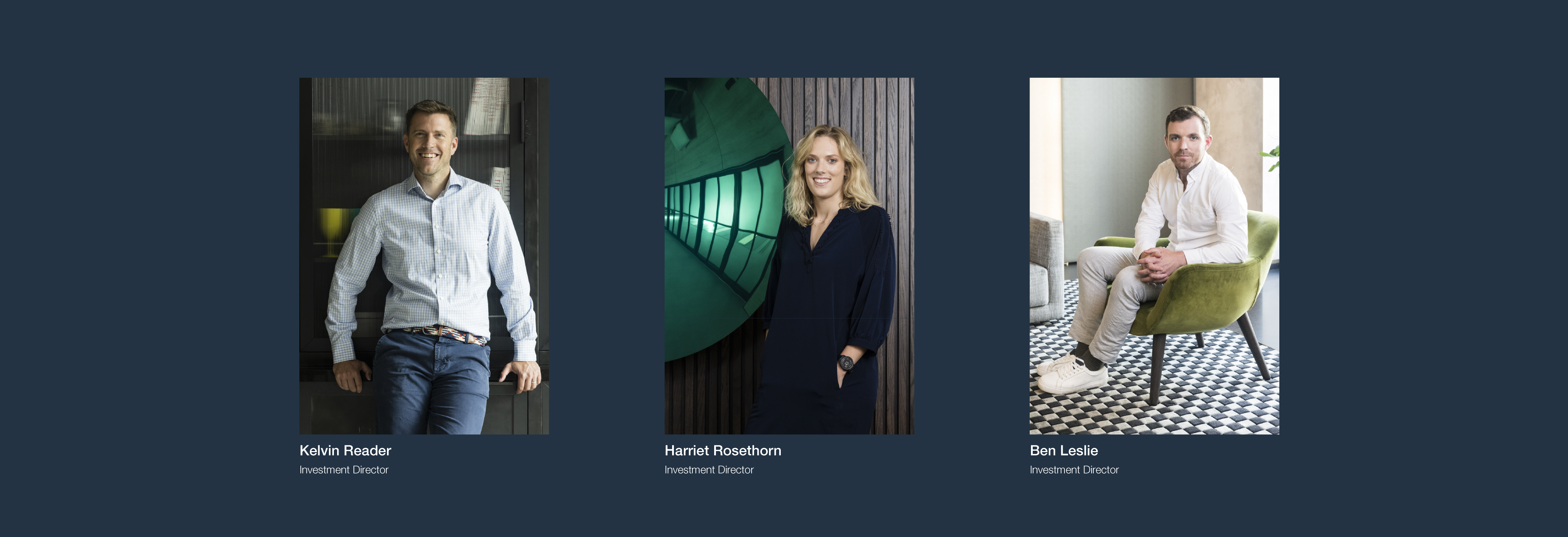

The following promotions have been announced:

| Ben Leslie is promoted to Investment Director. Ben joined Puma in 2018 from Deloitte and brings a keen focus on social purpose businesses having managed successful investments into Connectr, Everpress, and Puma’s early years education positions. Ben is responsible for the firm’s investment activity in Scotland. |

| Kelvin Reader has also been promoted to Investment Director. Kelvin joined Puma in 2019 from Station 12 and PWC. During his time at Puma, Kelvin has led several successful investments including digital product design and technology business Ostmodern, software developer marketplace Deazy, as well as Puma’s exit from special needs education business, SEN, which delivered a 3.2x return. |

| Harriet Rosethorn has also been promoted to Investment Director. Harriet joined Puma in 2017 from GP Bullhound and has worked on a number of successful investments including piracy tracking business Muso, influencer marketing platform Influencer and global digital wellbeing platform TicTrac (now successfully exited). |

| The team are joined by James Craig as Portfolio Value Creation Lead. James brings extensive experience of driving value creation and performance improvements both as a consultant, at Accenture then Baringa, and as an investor, as Change Director at ScaleUp Capital. |

| Charlotte Howe also joins Puma Private Equity as Investment Executive. Charlotte was previously at PwC where she was part of the lead advisory team with experience in both M&A and Restructuring. |

Commenting on the changes, Rupert West, Managing Director of Puma Private Equity commented

“We are investing heavily in our team to continue providing genuine support to our portfolio companies as we grow our activities and navigate together through the current uncertain environment. 2022 was a record year of fundraising for us and we look forward to welcoming many further businesses into our portfolio during 2023. I’m delighted to promote Harriet, Kelvin and Ben to Investment Director; they personify our ethos of highly active value creation through deep relationships, and are valued by colleagues and portfolio management teams alike.”