About us

Our strategy is to combine our investment in deep relationships with a truly rigorous and human approach – amplifying the successes of those we partner with to create positive outcomes for our investors and society.

Our journey

We grew out of the Shore Capital Group - a privately held, independent investment group specialising in equity capital market activities, alternative asset management and principal finance. Shore Capital is a highly regarded organisation across its chosen markets, and we are proud to have been created from its success.

In 2012, Puma was established by our CEO, David Kaye, as an independent company. It was initially created to build upon a series of Venture Capital Trusts (VCTs) known as the Puma VCTs, which had been successfully managed for several years by Shore Capital.

Over the last ten years, we have grown in the breadth and scale of our offering. Today, we’re an established and dynamic group of companies, managing more than £900 million in assets from private and institutional investors; we have lent more than £1 billion in development finance and helped more than 50 companies on their journeys to success.

While we remain part of the Shore Capital Group and can draw upon its vast resources and networks across the UK and internationally, we are an operationally independent entity. This means we can combine an established institution's professionalism, rigour and stability with the autonomy, agility and drive of a business with big ambitions for the future.

DOWNLOAD: INTRODUCTION TO OUR GROUP

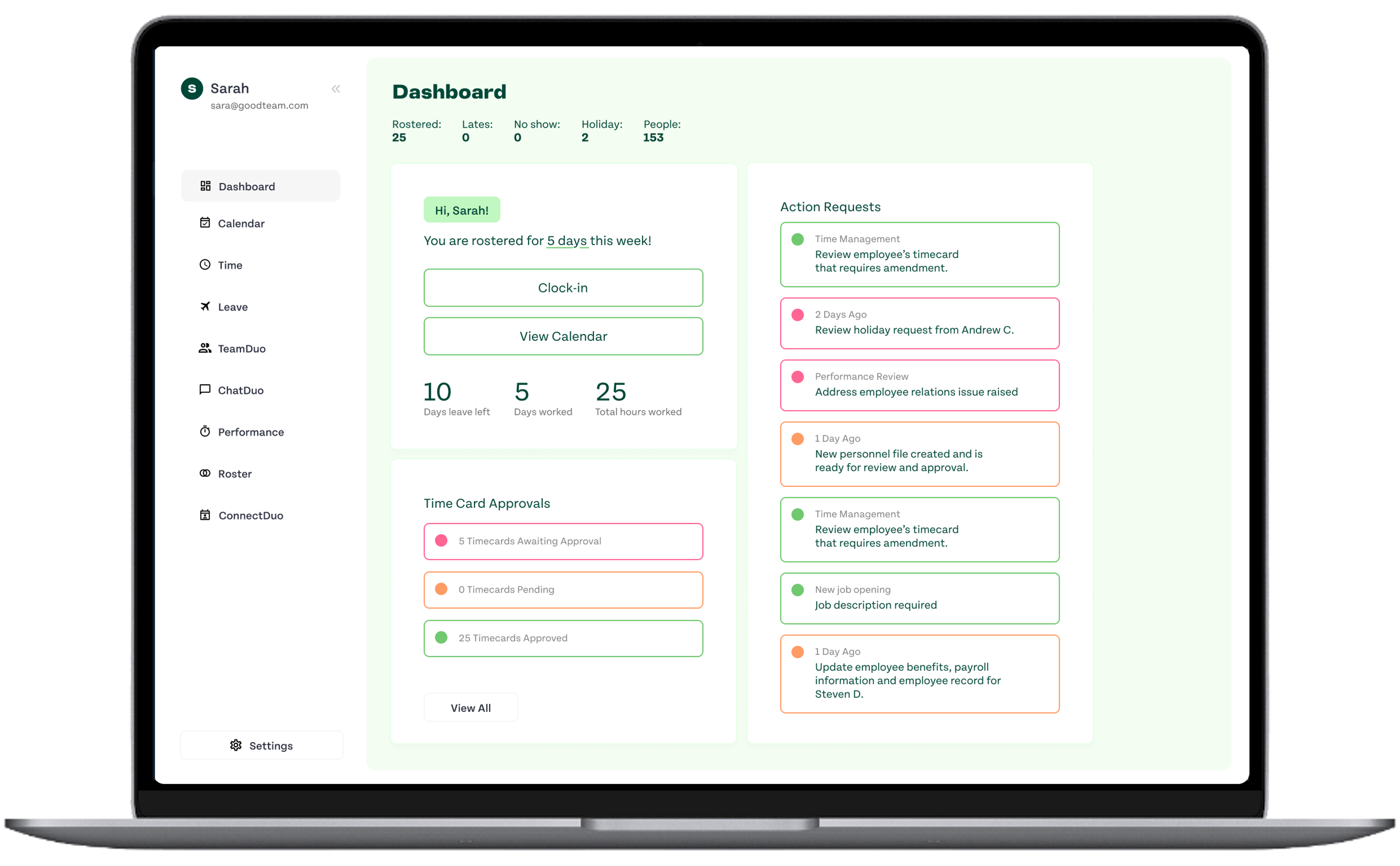

Puma Capital Group in numbers

Across all aspects of our Group, our numbers continue to grow. And we are proud to have helped so many individuals achieve their ambitions. As of November 2023, we have built up some impressive numbers over the preceding years.

CURRENT INVESTORS

EMPLOYEES

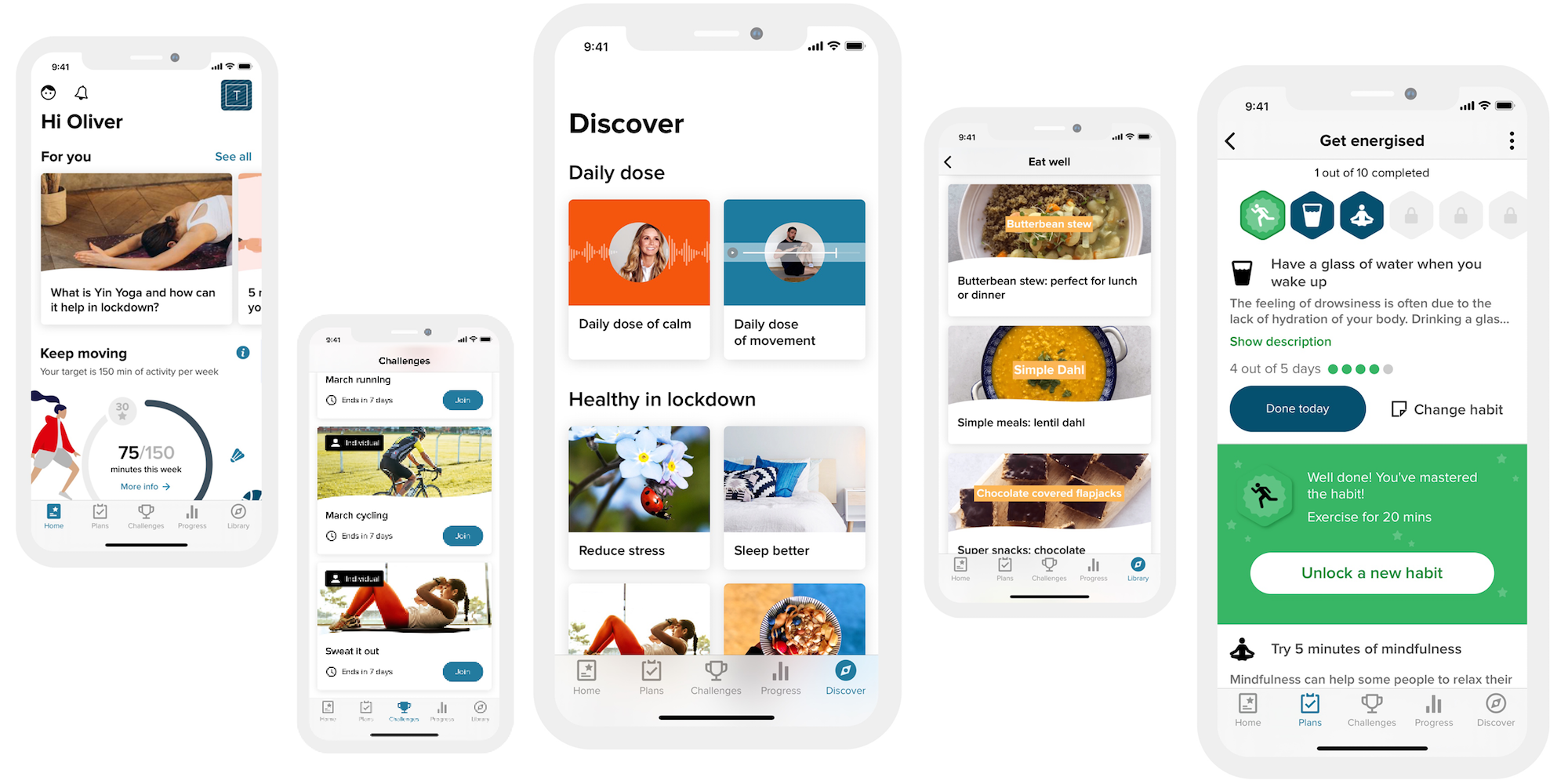

VCT AND EIS COMPANY INVESTMENTS

LOANS PROVIDED BY PUMA HERITAGE LTD

Our leadership team

Our talented team bring a range of diverse views and experiences together to help our clients and our partners to prosper.

Living by our principles

We are committed to various environmental, social and governance (ESG) principles that help us operate effectively and invest responsibly. In adopting these principles, we want to ensure that everyone who works with us has the same aim – to support our stakeholders and positively impact the wider community to which we belong. These principles cover five broad areas:

- Governance

- Environment

- Marketplace

- Workplace

- Community

Governance

As a business regulated by the Financial Conduct Authority (FCA), we are governed by laws, regulations and rules of conduct to which we must adhere. We have an experienced compliance team to monitor and ensure our adherence, including through regular staff training and assessment.

Transparency is vital to our culture. We will always decline an opportunity where we have hesitations about its integrity rather than expose our clients, partners or ourselves to unnecessary risk. To ensure extra rigour in our transactions, our private equity investments and property finance loans must also receive approval from our investment or credit committees.

Our risk, compliance, and legal teams are heavily involved in our investment and lending decisions and enact rigorous research before any transaction is approved. We will not engage with any person or entity on an internationally recognised ‘deny list’.

To deliver further transparency, we also produce quarterly due diligence questionnaires about each of our open offers.

In addition, our open Venture Capital Trusts are listed on the main list of the LSE, and some of our offers are on a panel with several financial adviser groups, who run their own detailed due diligence processes.

DOWNLOAD: ESG BROCHURE